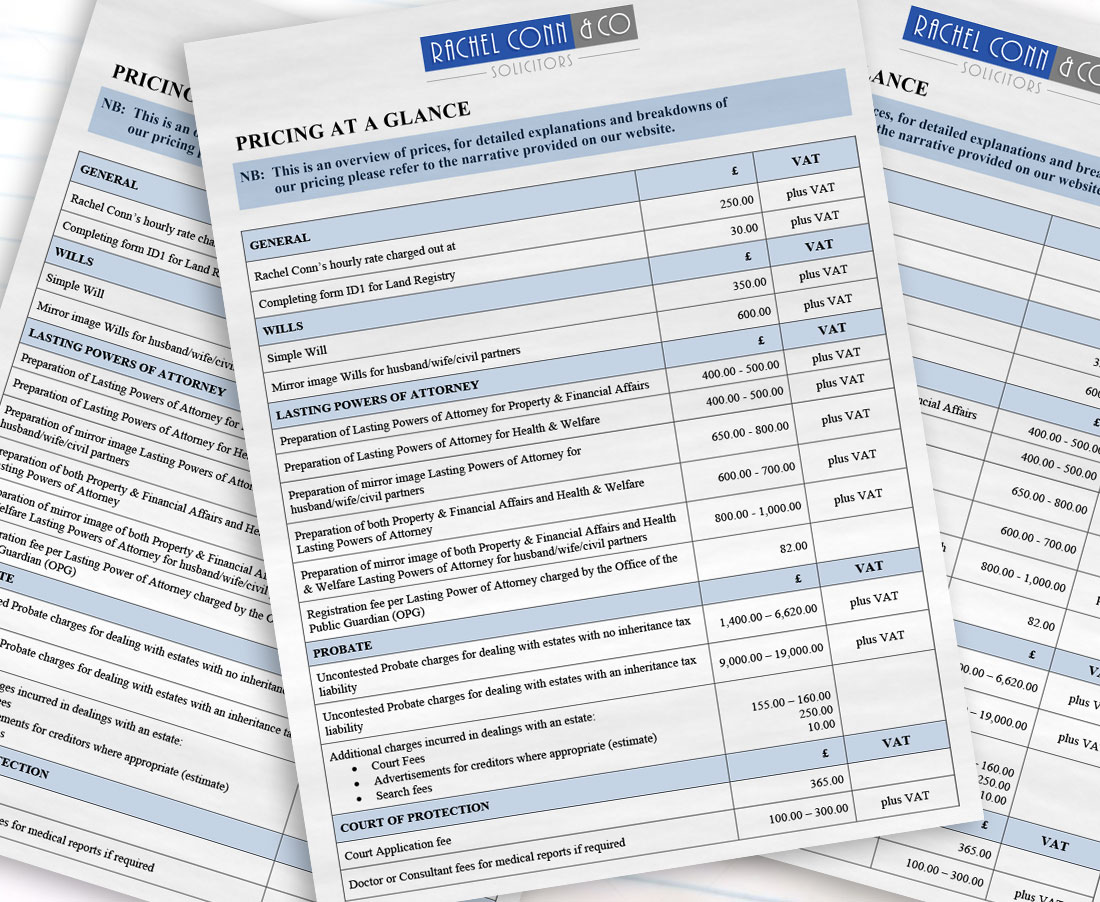

PRICING

We are VAT registered and charge VAT at the current rate (which stands at 20%) for the work we do. The following fees apply from 01/04/2019. We review them each year.

Completing form ID1 for the Land Registry

£ 30.00 plus VAT

Simple Will

£350.00 plus VAT

Mirror image simple Wills for husband and wife/civil partners

£600.00 plus VAT

If you need a complex Will, please ring Rachel for a cost estimate to cover what you want to say. Our fees cover an initial interview, sending you a draft Will to check, making minor amendments or corrections and providing two witnesses to sign your Will with you.

Lasting Power Of Attorney (LPA)

The registration fee is £82.00. This is charged by the Office of the Public Guardian (OPG) for each LPA registered. Concessions are available from the OPG upon application. Our fees for preparing a Lasting Power of Attorney for Property and Affairs range from £400.00 - £500.00 plus VAT. Mirror image LPA's for husband and wife/civil partners range from £650.00 - £800.00 plus VAT.

The same pricing applies for a Lasting Power of Attorney for Health and Welfare. If you want both kinds of LPA the total cost ranges from £600.00 - £700.00 plus VAT. If your LPAs are required for husband and wife/civil partners the cost ranges from £800.00 - £1,000.00 plus VAT.

Included in these charges are witnessing your signature, being a certificate provider as required by the forms, and supplying certified copies of the originals. For Wills and LPA's a personal face to face meeting is required. We are unable to carry out the entire retainer by email, post or telephone.

Uncontested Probate

We charge for Rachel Conn’s time at £250.00 per hour plus VAT. There is no “value element” charged, regardless of whether Rachel Conn is your executor or not.

Our fees here range from £1,400.00 - £6,620.00 plus VAT for dealing with estates with no inheritance tax liability. More time is spent dealing with multiple beneficiaries and assets outside the UK.

Where there is an inheritance tax liability our fees range from £9,000.00 - £19,000.00 depending on the location and nature of the asset and the time spent, claiming tax reliefs and sustaining them. Other expenses we would incur are the probate Court fee of £155.00 - £160.00, advertisements for creditors where appropriate, around £250.00 plus VAT and search fees of around £10.00.

If you would like us to sell a property in an estate on behalf of executors, we will refer you to another solicitors practice to have this work completed. We do not do mortgage work or conveyancing work.

Court of Protection

The Court application fee is £365.00 There may be a doctor or consultant’s fee for preparing a medical report. This can range from £100.00 - £550.00 plus VAT, or there may be no fee charged at all: this is a matter for the practitioner.

Once the order is made, a Deputy appointed by the Court is required to pay a premium for a security bond. The level of cover is set by the Court of Protection. These expenses are payable from the funds of 'P' (the person the application is about).

This firm prefers to have its own costs independently assessed by the Senior Courts Costs Office which Will determine the hourly rate which applies and whether the time spent is reasonable. A solicitor’s costs may also be raised in line with Practice Direction B on the Courts and Tribunals Judiciary website listed as pd-19b-fixed-costs.pdf